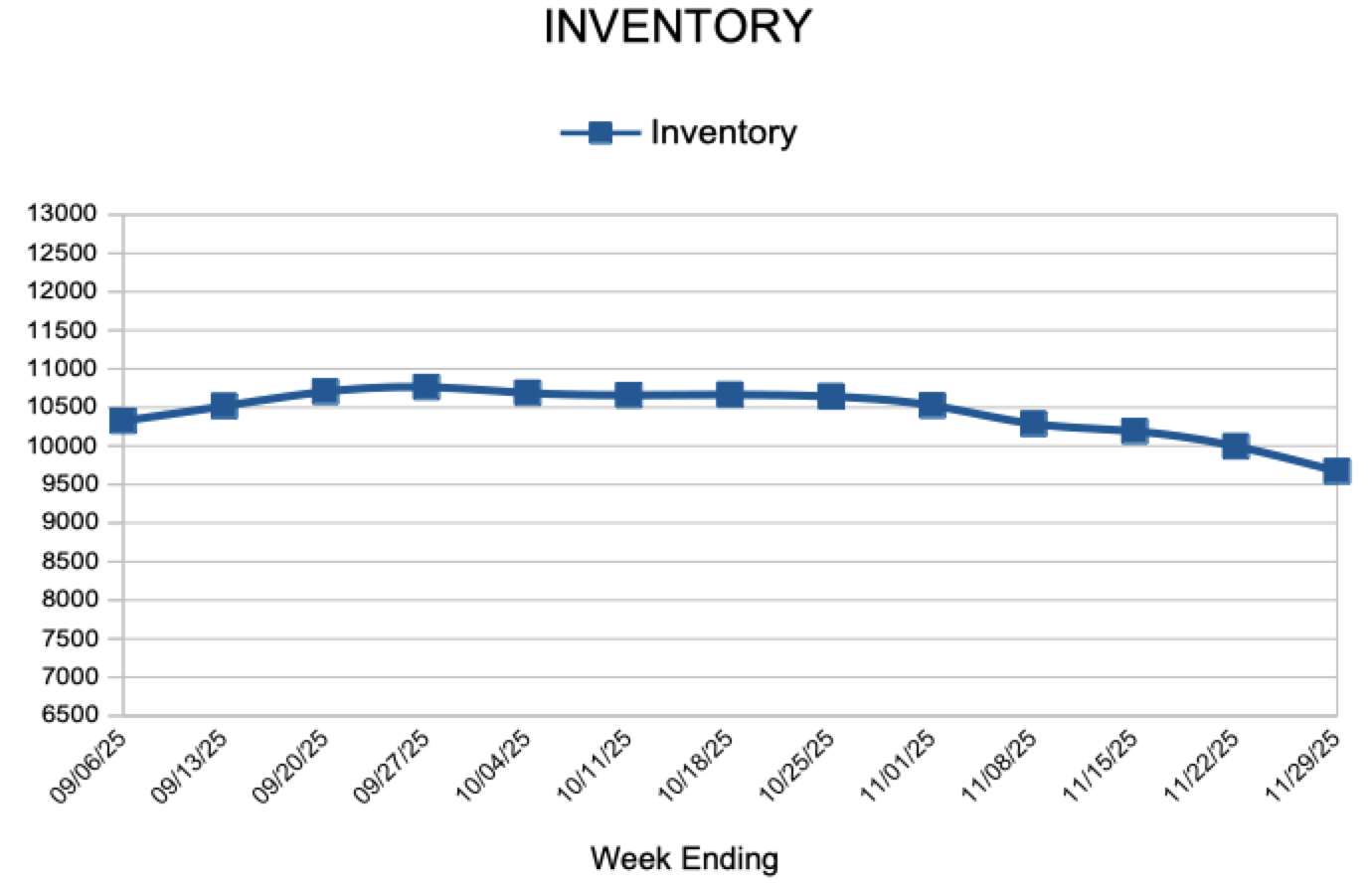

Inventory

For Week Ending November 29, 2025

For Week Ending November 29, 2025

U.S. homeowners earned an average profit of 49.9% on the sale of single-family homes and condominiums in the third quarter of 2025, according to ATTOM’s latest U.S. Home Sales Report. That figure is up slightly from 49.3% in the second quarter, but remains below the 55.4% recorded during the third quarter of 2024. The typical homeowner realized a profit of $123,100 in the third quarter, up 1.9% from the previous quarter but down 3.5% from a year earlier.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 29:

- New Listings decreased 11.6% to 465

- Pending Sales decreased 7.0% to 556

- Inventory increased 0.5% to 9,671

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 2.1% to $389,900

- Days on Market increased 6.7% to 48

- Percent of Original List Price Received increased 0.3% to 98.1%

- Months Supply of Homes For Sale decreased 3.6% to 2.7

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

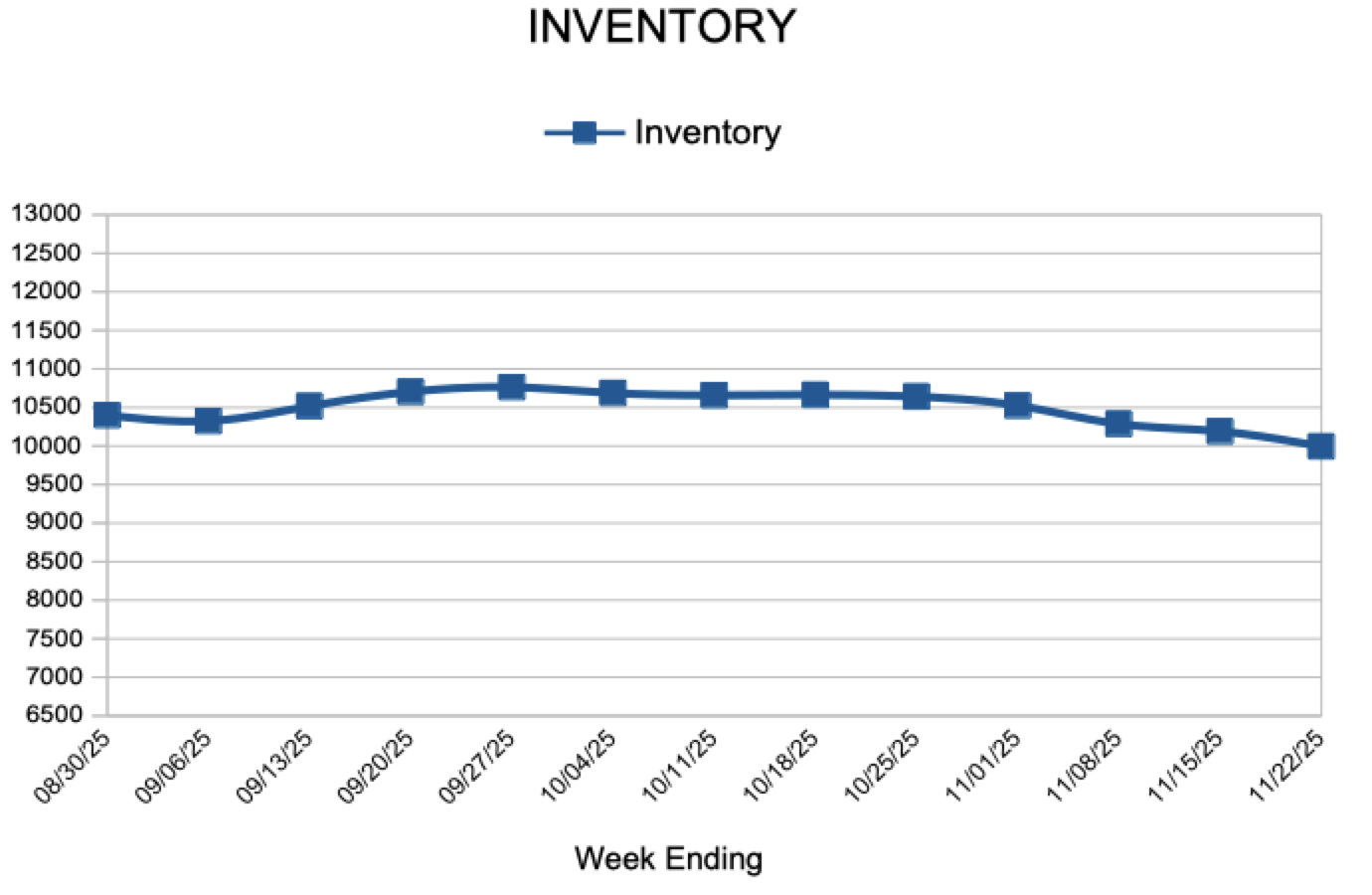

For Week Ending November 22, 2025

For Week Ending November 22, 2025

Nearly one-third (32.8%) of all homes sold in the first half of 2025 were paid for in cash, down 0.6% from the same period last year, according to a recent report from Realtor®.com. Cash sales were most common at the low and high ends of the price spectrum and vary across regions, with lower-priced and second-home markets often seeing more all-cash transactions than other areas.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 22:

- New Listings increased 8.1% to 949

- Pending Sales decreased 2.3% to 773

- Inventory increased 0.4% to 9,994

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 2.1% to $389,900

- Days on Market increased 6.7% to 48

- Percent of Original List Price Received increased 0.3% to 98.1%

- Months Supply of Homes For Sale decreased 3.6% to 2.7

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

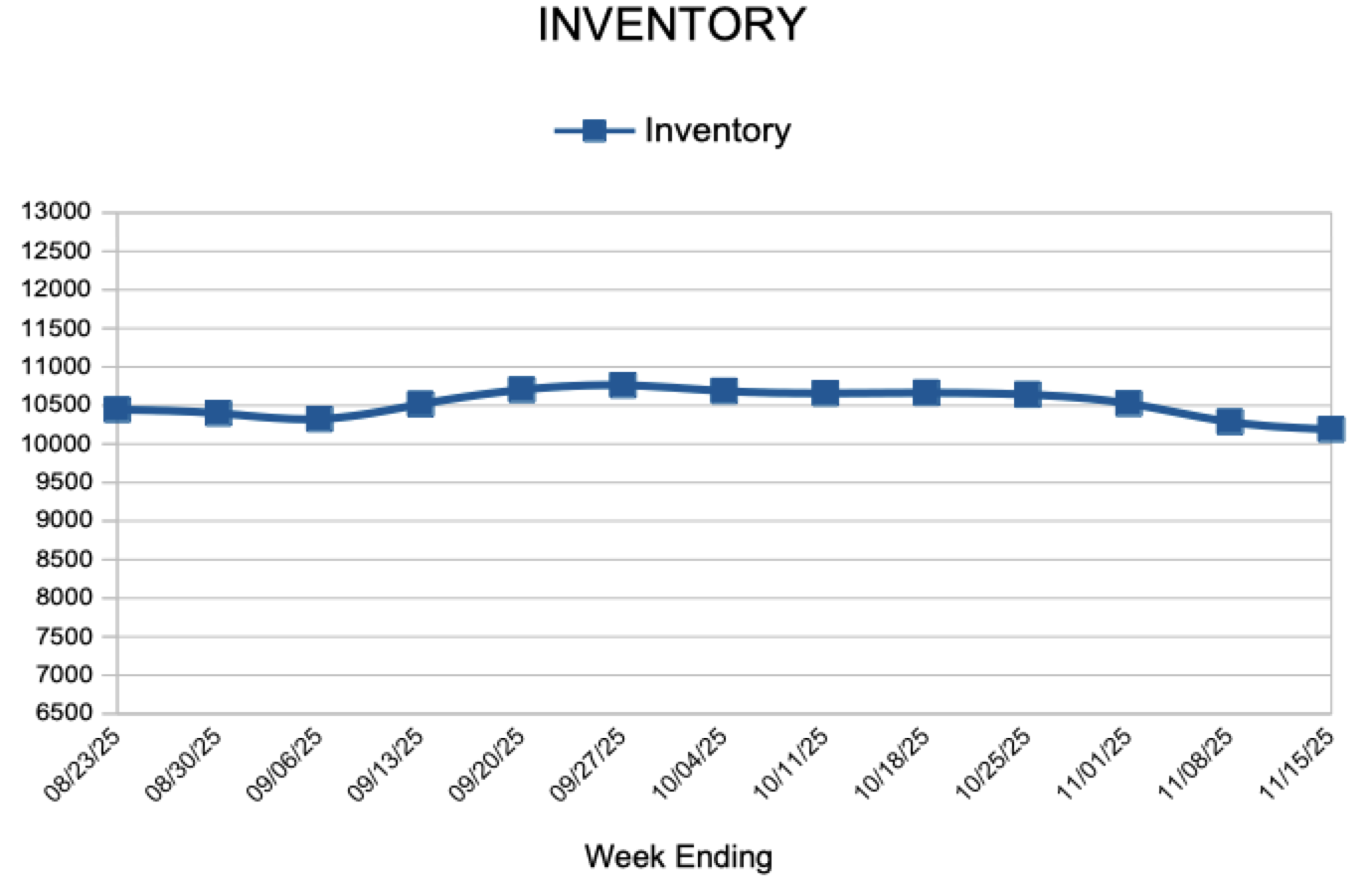

For Week Ending November 15, 2025

For Week Ending November 15, 2025

The U.S. housing supply gap reached 3.8 million units in 2024, according to an analysis by Realtor®.com. For the first time since 2016, new construction outpaced household formations, with more than 1.6 million units completed last year, the highest level in nearly two decades. While builders are making progress, it would still take about 7.5 years to close the housing gap at the 2024 pace of construction.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 15:

- New Listings increased 0.7% to 1,022

- Pending Sales decreased 1.8% to 774

- Inventory increased 0.8% to 10,190

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 2.1% to $389,900

- Days on Market increased 6.7% to 48

- Percent of Original List Price Received increased 0.3% to 98.1%

- Months Supply of Homes For Sale decreased 3.6% to 2.7

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.